extended child tax credit calculator

The Longs and the. The Joint Committee on Taxation estimated that the 2021 advance child tax credits expansion would cost 110 billion.

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Without further congressional action the child tax credit will revert back to 2000.

. The cost of extending it until 2025 has been estimated at around 450. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. First its value was boosted to a 3000 maximum for children aged 6 to 17 and a 3600 maximum for children under the age of 6.

But others are still pushing for. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. You can calculate your credit here.

The payment for children. Your amount changes based on the age of your children. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. There are also maximum amounts you must consider. Use our Benchmark Tool to get started.

But the changes werent permanent. Estimate your 2021 Child Tax Credit Monthly Payment. Enter the number of qualifying dependents between the ages 6 and 17 age as of Dec.

The maximum is 3000 for a single qualifying person or 6000 for two or more. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. Here is some important information to understand about this years Child Tax Credit.

The child tax credit provides a financial benefit to Americans with qualifying kids. Its a much bigger credit for potential taxpayers in tax year 2021. Enhanced credit could be extended through 2025.

Arabic عربى Bosnian Bosanski Chinese 中文 English English French Français. Your amount changes based on the age of your children. STOCK PHOTOGetty Images.

Kynects Premium Tax Credit calculator helps you find your benchmark plan or Second Lowest Cost Silver Plan SLCP. For tax years before 2021 the IRS allowed you to claim up to 2000 per child under 17. Making the credit fully refundable.

Ad The new advance Child Tax Credit is based on your previously filed tax return. According to the IRS. To reconcile advance payments on your 2021 return.

Families could qualify for up to 3000 per child between ages 6 and 17 and 3600 per child under 6 and receive half of the sum before actually filing their taxes. The Child Tax Credit provides money to support American families. How much is the child tax credit worth.

Get your advance payments total and number of qualifying children in your online account. Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for. Millions of families across the US will be receiving their.

Last year the Child Tax Credit got a number of key enhancements. How many can I claim. 30003600 child tax credit.

Child tax credit. Congress fails to renew the advance Child Tax Credit. Enter the number of qualifying dependents aged 5 or younger age as of December 31 2021 for Tax Year 2021 including dependents or children born during 2021.

The credit will be fully refundable. Standard child tax credit The Martins would receive a check for some of the child tax credit left after paying taxes but lose 1300 that could be used only to pay income tax. The monthly installments will end.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Your amount changes based on your income. The payment for children.

The child tax credit provides up to 2000 per child with a partial. The first one applies to the extra credit amount added to. Child Tax Credit.

Child Tax Credit amounts will be different for each family. 31 2021 for Tax Year 2021. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses. The advance is 50 of your child tax credit with the rest claimed on next years return.

Your Adjusted Gross Income AGI determines how much you can claim back. Reps kynectors Agents Help FAQs. Although the expanded child tax credit of 2021which sent advance monthly payments to parents for six months in 2021 as part of the American Rescue Plan Actis over the original child tax credit is once again available to parents of children under 17.

Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. Tax Changes and Key Amounts for the 2022 Tax Year. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021.

Enter your information on Schedule 8812 Form 1040. Stock photo of calculator. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

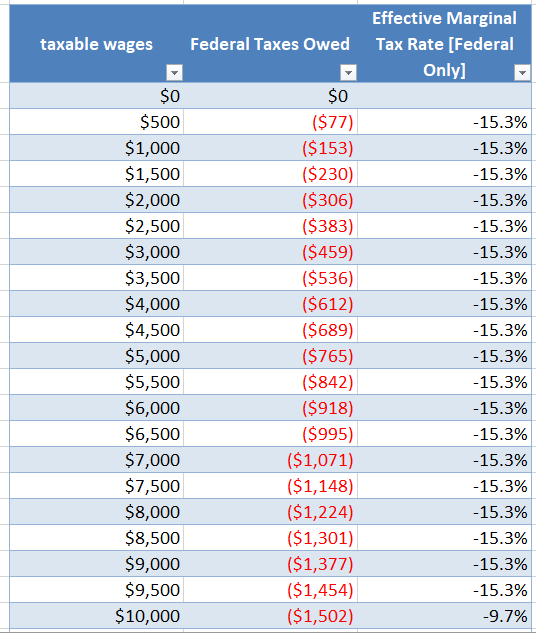

2021 Tax Calculator Frugal Professor

Try The Child Tax Credit Calculator For 2021 2022

Explore Our Image Of Monthly Spending Budget Template For Free Budget Template Budgeting Worksheets Worksheet Template

Tax Calculator Income Tax Tax Preparation Tax Brackets

How To Calculate Taxable Income H R Block

Aca Penalty Calculator Health Insurance Coverage Employment Full Time Equivalent

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Ppf Calculator With Extension Check Ppf Extension Returns In 3 Quick Easy Steps In 2021 Safe Investments Public Provident Fund Tax Free Savings

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Top Tax Refund Calculators In 2022 To Estimate Irs Payments With New Child Tax Credit

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Tax Credit Definition How To Claim It

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

2021 Child Tax Credit Calculator Internal Revenue Code Simplified

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor