operating cash flow ratio importance

In practice required payments for reserve accounts as well as multiple tranches of debt create a more complex hierarchy. The price-to-cash-flow ratio is a stock valuation indicator that measures the value of a stocks price to its cash flow per share.

Price To Cash Flow Formula Example Calculate P Cf Ratio

The operating cash flow formula can be calculated two different ways.

. Operating income Net Earnings Interest Expense Taxes. None more so than this which highlights the vital importance of cash to modern small businessesWhile profit turnover and even market share are all indicators. The ratio takes into consideration a.

Negative Cash Flows and Postive Net Income Examples. Cash Ratio 25000 21000 15000 15000 Cash Ratio 153. Same Business Can Yield Different Returns.

This calculation is simple and accurate but does not give investors much information about the company its operations or the sources of cash. The cash operating cycle concept of working capital for a business is the main indicator of whether the working management strategy of a business is effective. Below are some examples of top companies with Negative cash flows and Positive net income.

Cash flow is an important statement that auditors analysts and other parties use to check the sustainability of the net profit. Cash-flow management is vital to the health of your business and it is in the day-to-day management. Importance of Cash Operating Cycle.

Operating activities include a companys day-to-day activities for example purchasing raw materials or making sales. Here the cash flow from operation comes from the statement of cash and cash flow from current liabilities comes off the balance sheet. In the simple example above we showed a simple payment hierarchy with CFADS first going to senior debt followed by payments to equity.

Capital structure ratios are very important to analyze the financial statements of any company for the following reasons. Operating income Total Revenue Direct Costs Indirect Costs. Generally cash flow statements are divided into three main parts.

Learn Basic Accounting Ratio Analysis Tutorial Accounting Interview Questions Debit vs Credit in Accounting Accounting Equation. The bottom line of the cash flow statement shows the net increase or decrease in cash for the period. Cash inflows result from cash sales and collection of accounts receivable.

Formula for Operating income. The first way or the direct method simply subtracts operating expenses from total revenues. And 3 financing activities.

An optimal cash conversion cycle can help the business run its operations smoothly and can also positively impact the profit and earnings of a business. Operating cash flow is an important benchmark for an analyst to determine the companys financial stability using its core business activities. Each part reviews the cash flow from one of three types of activities.

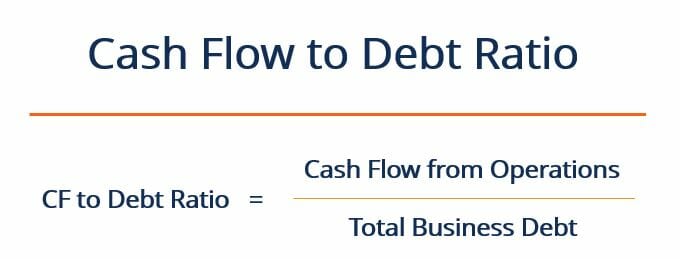

Operating Cash Flow Ratio Cash Flows From OperationsCurrent Liabilities. If cash flow is not showing any jump then most of the sales are made on credit and there is a risk regarding the recovery. There are three formulas to calculate income from operations.

As cash ratio is 153 which means the company has more cash than they need to pay off current liabilities. 261 or 6 cents per share growth year-over-year and flat. Read more 8653 million in 2016 and has led to Negative Cash Flow from Operating Activities.

If suppose the operating cash flow ratio of an entity is less than 10 the entity is not generating enough money to pay off its. This cash-flow hierarchy is modeled as a waterfall. Growing free cash flow per share and the return of capital to shareholders Element generated 029 of FCF per share in the first quarter.

Operating Cash Flow. Current ratio 26 Liquidity ratio or acid test or quick ratio 26. Therefore they are readily available in the income statement and help to determine the net profit.

There are multiple uses of cash ratio which are as follows-The cash ratio measures the liquidity of the company. The importance of Operating activities. Operating income Gross Profit Operating Expenses Depreciation Amortization.

The cash flow generated from operating activities is termed operating cash flow. This is a guide to Cash Flow Statement Examples.

Operating Cash Flow Ratio Calculator

Operating Cash Flow Definition Formula And Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Operating Cash Flow Ratio Definition Formula Example

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

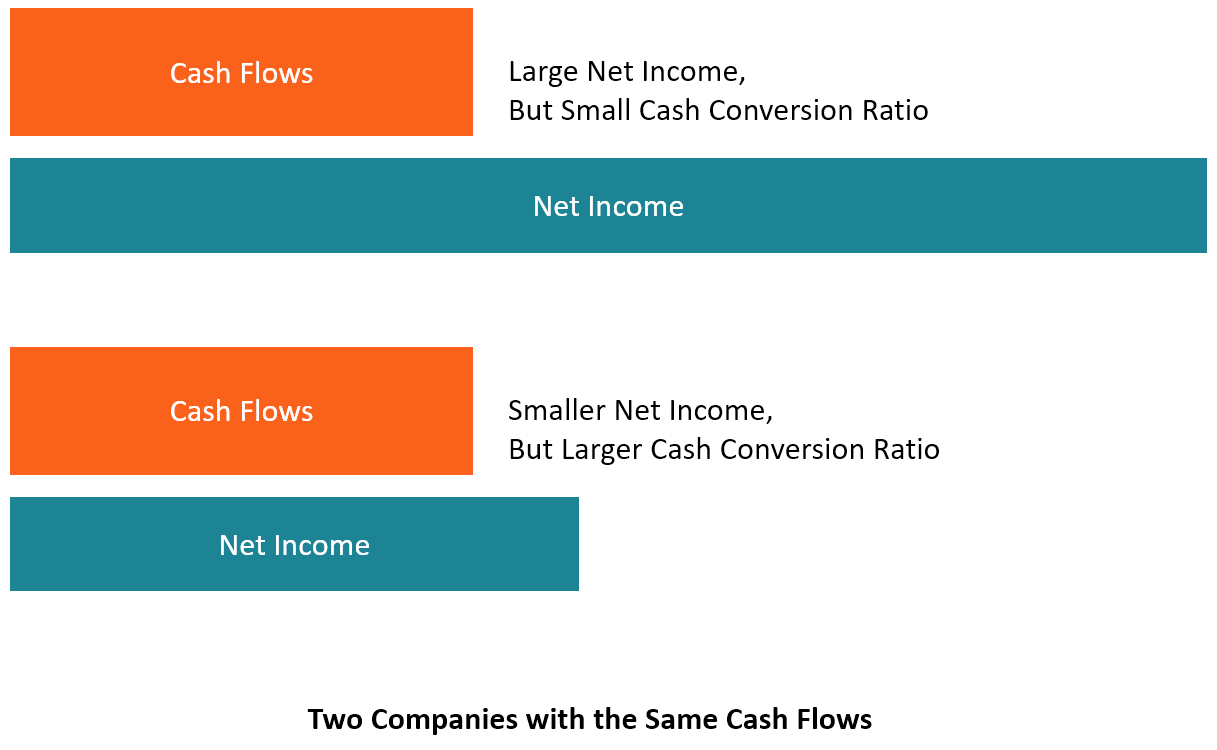

Free Cash Flow Conversion Fcf Formula And Example Analysis

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow Formula Calculator Excel Template

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)